Latest Version

Version

10.37.5

10.37.5

Update

December 22, 2023

December 22, 2023

Developer

Paytm - One97 Communications Ltd.

Paytm - One97 Communications Ltd.

Categories

Finance

Finance

Platforms

Android

Android

Downloads

1

1

License

Free

Free

Package Name

net.one97.paytm

net.one97.paytm

Report

Report a Problem

Report a Problem

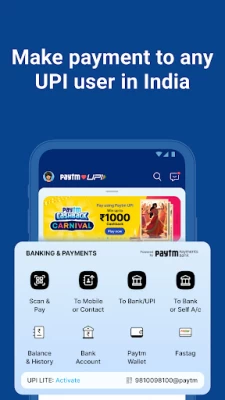

More About Paytm: Secure UPI Payments

Paytm (पेटीएम), India’s #1 Payment App, is trusted by more than 45 Crore Indians. Paytm is one stop solution for all your payment needs:

● Send money to your friends and family using mobile number via Paytm UPI. Including those who are not on Paytm.

● Scan any QR code and make payments at grocery stores, petrol pumps, restaurants etc.

● Recharge your mobile and pay your utility bills (electricity, gas, water, broadband etc.) easily.

Just link your bank account on Paytm with your registered phone number and get started. Download now!

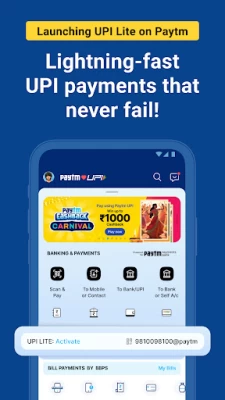

Safe, Reliable and Superfast UPI Payments

● Enter mobile number & transfer money to anyone using Paytm UPI.

● Check your bank account balance and view transaction history on Paytm.

● Your UPI ID is a unique ID used to make payments using Unified Payment Interface (UPI).

● Set your UPI PIN, which is a 4 or 6 digit number. It’s mandatory to set the PIN while creating UPI ID on the UPI app.

● Use UPI Lite for lightning-fast UPI Payments up to Rs 200, no PIN required.

Fast, Secure & Contactless QR code Payments

● Instant payment at any shop with our UPI payment app

Easy Recharge and Utility Bill Payments

● Recharge your mobile, DTH or pay electricity bills, broadband, water and other utility bills

● Find latest prepaid recharge plans & mobile recharge offers on Jio recharge, Airtel recharge, Vodafone Idea (VI) recharge, MTNL & BSNL recharge

● Buy & recharge fastag

Fast & Reliable Payments at Online Stores

● Make payment at food delivery, grocery, shopping & entertainment apps/sites & other 100+ apps.

Find great deals on grocery, food, and home decor items on Paytm ONDC app

● Shop grocery, food, electronics, home decor, and fashion on Paytm ONDC from stores near you at the lowest prices.

Check Free Credit Score

Get Instant Pre-approved Personal Loans

● Loan amount starting from 10K to 2.5 lac

● Repay loan within 3-60 months

● Annual percentage rate (APR) (per annum monthly reducing): 10.5-35%

● Loan Processing fee: 0- 6%

Note: Personal Loans are only available to Indian citizens within the territory of India

Lending partners (NBFC):

● Hero Fincorp Ltd: https://www.herofincorp.com/partners

● Aditya Birla Finance Ltd: https://personalfinance.adityabirlacapital.com/pages/individual/platform_partners.aspx

● Clix Capital Services Pvt. Ltd: www.clix.capital/our-partners/paytm/

Example:

Loan amount: 100,000, Interest 23%, Processing fee 4.25%, Tenure 18

Loan processing fee: Rs.4250

Stamp duty charges: applicable as per law

EMI per month: Rs.6621

Total interest: Rs.19178

Disbursal amount: Rs.94785

Amount Payable: Rs.119186

Use Postpaid Loan for all your everyday spends

● Postpaid Loan is a Spend Credit facility offered by Paytm’s NBFC partners in the form of small on-demand loans. It can be used to make online/offline purchases: groceries, fuel, shopping, restaurants, etc. Get instant credit of up to 60,000 and repay by 7th of next month.

● Credit Limit: 1,000 to 60,000

● Bill generation: 1st of every month

● Last date for repayment: 7th of the month

● Convenience fee: 0% to 3% plus GST

Eg:

A user has credit limit of 10,000 with 1% convenience charge. If the user spends Rs. 5,000 in Jan, then on 1st Feb a bill for Rs.5,059 (spends + 1% convenience fee + GST) will be generated.

Our Lending partners:

● Aditya Birla Finance Ltd

● SMFG India Credit Company Ltd (Formerly Fullerton India Credit Company Ltd.)

Book Tickets for Trains, Bus, & Flights

● Book domestic & international flights, bus tickets online

● Paytm is an authorized IRCTC partner for Rail e-ticket booking, cancellation, PNR status & live train status

Contact Us

One 97 Communications Limited

One Skymark, Tower-D, Plot No. H-10B,Sector-98, Noida UP 201304 IN

*Paytm Money Ltd. is a wholly owned subsidiary of One97 Communication Ltd. (Paytm) and is registered with SEBI and PFRDA as Stock broker (INZ000240532) and e-pop (269042019) for NPS services

● Scan any QR code and make payments at grocery stores, petrol pumps, restaurants etc.

● Recharge your mobile and pay your utility bills (electricity, gas, water, broadband etc.) easily.

Just link your bank account on Paytm with your registered phone number and get started. Download now!

Safe, Reliable and Superfast UPI Payments

● Enter mobile number & transfer money to anyone using Paytm UPI.

● Check your bank account balance and view transaction history on Paytm.

● Your UPI ID is a unique ID used to make payments using Unified Payment Interface (UPI).

● Set your UPI PIN, which is a 4 or 6 digit number. It’s mandatory to set the PIN while creating UPI ID on the UPI app.

● Use UPI Lite for lightning-fast UPI Payments up to Rs 200, no PIN required.

Fast, Secure & Contactless QR code Payments

● Instant payment at any shop with our UPI payment app

Easy Recharge and Utility Bill Payments

● Recharge your mobile, DTH or pay electricity bills, broadband, water and other utility bills

● Find latest prepaid recharge plans & mobile recharge offers on Jio recharge, Airtel recharge, Vodafone Idea (VI) recharge, MTNL & BSNL recharge

● Buy & recharge fastag

Fast & Reliable Payments at Online Stores

● Make payment at food delivery, grocery, shopping & entertainment apps/sites & other 100+ apps.

Find great deals on grocery, food, and home decor items on Paytm ONDC app

● Shop grocery, food, electronics, home decor, and fashion on Paytm ONDC from stores near you at the lowest prices.

Check Free Credit Score

Get Instant Pre-approved Personal Loans

● Loan amount starting from 10K to 2.5 lac

● Repay loan within 3-60 months

● Annual percentage rate (APR) (per annum monthly reducing): 10.5-35%

● Loan Processing fee: 0- 6%

Note: Personal Loans are only available to Indian citizens within the territory of India

Lending partners (NBFC):

● Hero Fincorp Ltd: https://www.herofincorp.com/partners

● Aditya Birla Finance Ltd: https://personalfinance.adityabirlacapital.com/pages/individual/platform_partners.aspx

● Clix Capital Services Pvt. Ltd: www.clix.capital/our-partners/paytm/

Example:

Loan amount: 100,000, Interest 23%, Processing fee 4.25%, Tenure 18

Loan processing fee: Rs.4250

Stamp duty charges: applicable as per law

EMI per month: Rs.6621

Total interest: Rs.19178

Disbursal amount: Rs.94785

Amount Payable: Rs.119186

Use Postpaid Loan for all your everyday spends

● Postpaid Loan is a Spend Credit facility offered by Paytm’s NBFC partners in the form of small on-demand loans. It can be used to make online/offline purchases: groceries, fuel, shopping, restaurants, etc. Get instant credit of up to 60,000 and repay by 7th of next month.

● Credit Limit: 1,000 to 60,000

● Bill generation: 1st of every month

● Last date for repayment: 7th of the month

● Convenience fee: 0% to 3% plus GST

Eg:

A user has credit limit of 10,000 with 1% convenience charge. If the user spends Rs. 5,000 in Jan, then on 1st Feb a bill for Rs.5,059 (spends + 1% convenience fee + GST) will be generated.

Our Lending partners:

● Aditya Birla Finance Ltd

● SMFG India Credit Company Ltd (Formerly Fullerton India Credit Company Ltd.)

Book Tickets for Trains, Bus, & Flights

● Book domestic & international flights, bus tickets online

● Paytm is an authorized IRCTC partner for Rail e-ticket booking, cancellation, PNR status & live train status

Contact Us

One 97 Communications Limited

One Skymark, Tower-D, Plot No. H-10B,Sector-98, Noida UP 201304 IN

*Paytm Money Ltd. is a wholly owned subsidiary of One97 Communication Ltd. (Paytm) and is registered with SEBI and PFRDA as Stock broker (INZ000240532) and e-pop (269042019) for NPS services

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

APK MODInwepo.co

TOR Browser: OrNET Onion WebOrNET

GTA: Liberty City StoriesRockstar Games

Masha and the Bear Pizza MakerDEVGAME KIDS games

Merge - Connect to iPhoneMerge Solutions

Passion: Reading AppUnicorn Media Apps

Sago Mini School (Kids 2-5)Play Piknik

TelegramTelegram FZ-LLC

Asphalt 9: LegendsGameloft SE

Conflict of Nations: WW3 GameDorado Games / DOG Productions Ltd

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD