Latest Version

Version

23.50.1

23.50.1

Update

December 22, 2023

December 22, 2023

Developer

Credit Karma, LLC

Credit Karma, LLC

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.creditkarma.mobile

com.creditkarma.mobile

Report

Report a Problem

Report a Problem

More About Intuit Credit Karma

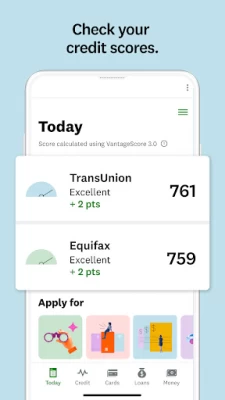

• Check your free credit scores – Learn what affects your credit scores and how you can take control.

• Credit Karma Money™ Spend – A checking experience* with Early Payday and Credit Builder.**

• Credit Karma Money™ Save – A no fee, high-yield savings account.*

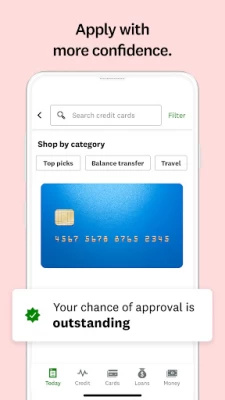

• Approval Odds*** – See personalized recommendations and know your chances of approval for a personal loan or credit card before you apply.

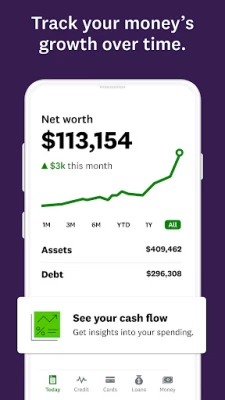

• Net Worth and Cash Flow – track your money stats so you can find ways to save more and build your wealth.

• Credit card choices – Browse great credit card offers based on your credit profile.

• Auto savings and more – Tune up your auto loan, see about saving on insurance, see open recalls and find vehicle records.

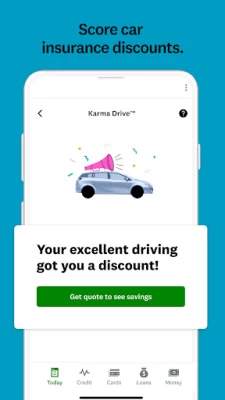

• Karma Drive™ – Track your safe driving score to see if you can unlock lower car insurance rates.

• Home sweet home – Calculate how much home you could afford, compare home loan offers and get a mortgage pre-qualification letter.

• Personal loan shopping – Whether you want to refinance credit card debt or borrow for an expense, you can compare personal loan offers on Credit Karma.

• Free credit monitoring – Get credit alerts when we see important changes happen to your Equifax or TransUnion credit reports.

Download the Credit Karma app today.

DISCLOSURES

*Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account. Credit Builder is not provided by MVB Bank.

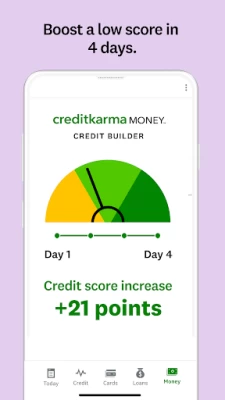

** A connected paycheck or one time direct deposit of $750 is required for activation. Credit Builder plan is serviced by Credit Karma Credit Builder and requires a line of credit and savings account provided by Cross River Bank, Member FDIC. Members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 21 points in 4 days of activating the plan.

***Approval Odds are not a guarantee of approval. Credit Karma looks at how your credit profile compares to other Credit Karma members who were approved for the offer shown or whether you meet certain criteria determined by the lender.

Some screen images are simulated.

Mortgage products and services offered through Credit Karma Mortgage, Inc. NMLS ID# 1588622 | Read licenses at https://www.creditkarma.com/about/mortgage-licenses.

Loan services offered through Credit Karma Offers, Inc., NMLS ID# 1628077 | Read licenses at https://www.creditkarma.com/about/loan-licenses | California loans arranged pursuant to a California Financing Law license.

Insurance services offered through Karma Insurance Services, LLC. CA resident license #0172748.

ELIGIBILITY AND ADDITIONAL DETAILS; PERSONAL LOAN INTEREST RATES AND FEES. You can see personal loan offers on the Credit Karma personal loan marketplace from third party advertisers from which Credit Karma receives compensation. Credit Karma members are shown offers with Outstanding Approval Odds** when available to them. Offers with Outstanding Approval Odds have rates that range from 5.4% APR to 35.99% APR with terms from 12 months to 7 years. Rates are subject to change without notice and are controlled by our third party advertisers, not Credit Karma. Depending on the particular lender, other fees may apply, such as origination fees or late payment fees. See the particular lender’s terms and conditions for additional details. All loan offers on Credit Karma require your application and approval by the lender. You may not qualify for a personal loan at all or you may not qualify for the lowest rates or the highest offer amounts.

PERSONAL LOAN REPAYMENT EXAMPLE. The following example assumes a $15,000 personal loan with a four year (48 month) term. For APRs ranging from 5.4% to 35.99%, monthly payments would range from $349 to $594. Assuming all of the 48 payments are made on-time, the total amount paid would range from $16,712 to $28,492.

• Credit Karma Money™ Save – A no fee, high-yield savings account.*

• Approval Odds*** – See personalized recommendations and know your chances of approval for a personal loan or credit card before you apply.

• Net Worth and Cash Flow – track your money stats so you can find ways to save more and build your wealth.

• Credit card choices – Browse great credit card offers based on your credit profile.

• Auto savings and more – Tune up your auto loan, see about saving on insurance, see open recalls and find vehicle records.

• Karma Drive™ – Track your safe driving score to see if you can unlock lower car insurance rates.

• Home sweet home – Calculate how much home you could afford, compare home loan offers and get a mortgage pre-qualification letter.

• Personal loan shopping – Whether you want to refinance credit card debt or borrow for an expense, you can compare personal loan offers on Credit Karma.

• Free credit monitoring – Get credit alerts when we see important changes happen to your Equifax or TransUnion credit reports.

Download the Credit Karma app today.

DISCLOSURES

*Banking services provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account. Credit Builder is not provided by MVB Bank.

** A connected paycheck or one time direct deposit of $750 is required for activation. Credit Builder plan is serviced by Credit Karma Credit Builder and requires a line of credit and savings account provided by Cross River Bank, Member FDIC. Members with a TransUnion credit score of 619 or below who opened a Credit Builder plan and had it reported on their TransUnion report saw an average credit score increase of 21 points in 4 days of activating the plan.

***Approval Odds are not a guarantee of approval. Credit Karma looks at how your credit profile compares to other Credit Karma members who were approved for the offer shown or whether you meet certain criteria determined by the lender.

Some screen images are simulated.

Mortgage products and services offered through Credit Karma Mortgage, Inc. NMLS ID# 1588622 | Read licenses at https://www.creditkarma.com/about/mortgage-licenses.

Loan services offered through Credit Karma Offers, Inc., NMLS ID# 1628077 | Read licenses at https://www.creditkarma.com/about/loan-licenses | California loans arranged pursuant to a California Financing Law license.

Insurance services offered through Karma Insurance Services, LLC. CA resident license #0172748.

ELIGIBILITY AND ADDITIONAL DETAILS; PERSONAL LOAN INTEREST RATES AND FEES. You can see personal loan offers on the Credit Karma personal loan marketplace from third party advertisers from which Credit Karma receives compensation. Credit Karma members are shown offers with Outstanding Approval Odds** when available to them. Offers with Outstanding Approval Odds have rates that range from 5.4% APR to 35.99% APR with terms from 12 months to 7 years. Rates are subject to change without notice and are controlled by our third party advertisers, not Credit Karma. Depending on the particular lender, other fees may apply, such as origination fees or late payment fees. See the particular lender’s terms and conditions for additional details. All loan offers on Credit Karma require your application and approval by the lender. You may not qualify for a personal loan at all or you may not qualify for the lowest rates or the highest offer amounts.

PERSONAL LOAN REPAYMENT EXAMPLE. The following example assumes a $15,000 personal loan with a four year (48 month) term. For APRs ranging from 5.4% to 35.99%, monthly payments would range from $349 to $594. Assuming all of the 48 payments are made on-time, the total amount paid would range from $16,712 to $28,492.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

APK MODInwepo.co

TOR Browser: OrNET Onion WebOrNET

GTA: Liberty City StoriesRockstar Games

Masha and the Bear Pizza MakerDEVGAME KIDS games

Merge - Connect to iPhoneMerge Solutions

Passion: Reading AppUnicorn Media Apps

Sago Mini School (Kids 2-5)Play Piknik

TelegramTelegram FZ-LLC

Asphalt 9: LegendsGameloft SE

Conflict of Nations: WW3 GameDorado Games / DOG Productions Ltd

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD